Finally, a Rate Cut! - The Reserve Bank of Australia Announces Interest Rate Reduction to 4.1%

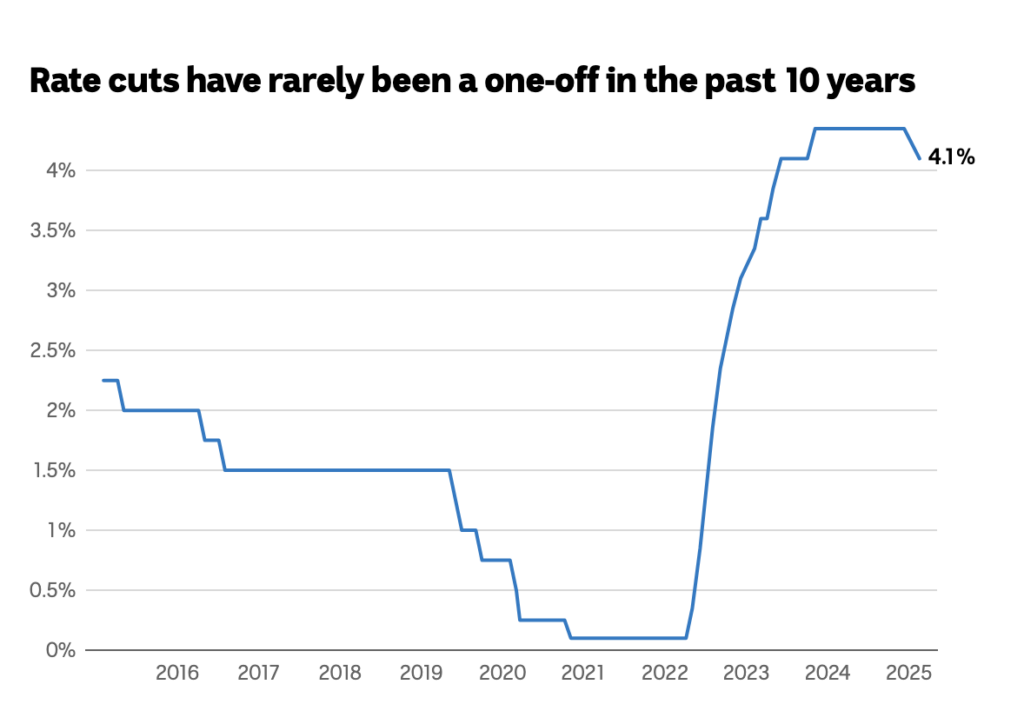

On February 18, 2025, the Reserve Bank of Australia (RBA) announced a reduction in the cash rate from 4.35% to 4.10% after a two-day monetary policy meeting. This decision marks the first adjustment since November 2023 and the first rate cut since May 2022. The 4.35% rate had been maintained for nearly 15 months, following a series of increases from the historical low of 0.5% that began in May 2022. The significance of this rate cut is clear.

RBA Governor Michele Bullock stated at the post-meeting press conference that the decision to cut rates was a "difficult one." She mentioned that the board engaged in intense discussions, weighing various perspectives before deciding to ease some restrictions to better achieve economic goals. Bullock emphasized that while higher interest rates have had the desired effects, it cannot yet be claimed that inflation has been conquered. She noted that the board plans to consider further actions only after confirming that inflation can sustainably return to the target range.

Treasurer Jim Chalmers welcomed the rate cut, stating it provides much-needed relief for the Australian public. While he acknowledged that the rate reduction won't solve all economic or household spending issues, he believes it will be beneficial for many. Chalmers emphasized that the decline in inflation aligns with the government's ongoing plan for a "soft landing" and revealed that the next federal budget will be announced on March 25.

Source: Reserve Bank of Australia